Rich Dad Poor Dad

Introduction | Rich Dad Poor Dad Summary

Rich Dad Poor Dad Summary. “The main reason people struggle financially is because they have spent years in school but learned nothing about money. The result is that people learn to work for money… but never learn to have money work for them.” –Robert Kiyosaki

Rich Dad Poor Dad played a key role in my life. That being said, I’m taking this opportunity to share the lessons I’ve learned from Rich Dad Poor Dad – for it has changed my life forever. I summarized the cashflow quadrant concept from Rich Dad Poor Dad series in a separate blog post.

The Lessons from Rich Dad | Rich Dad Poor Dad Summary

Here is an overview of Rich Dad’s lessons from Rich Dad Poor Dad:

- Lesson 1: The rich don’t work for money. They make money work for them.

- Lesson 2: It’s never about how much money you make. It’s how much money you keep.

- Lesson 3: The rich focus on their asset columns while everyone else focuses on their income statements.

- Lesson 4: Corporations are the biggest secret of the rich.

- Lesson 5: Often in the real world, it’s not the smart who get ahead, but the bold.

- Lesson 6: Work to learn. Don’t work for money.

Rich Dad’s lessons can be applied by following a series of steps that are integral to each other.

- On Financial Education: Invest in your financial education. When I say financial education, this pertains to your mindset and knowledge.

- On Mindset: Invest a lot of time in honing your ‘money mindset’—know the right way to manage your finances, because then again, it’s not about how much money you make, it’s about how much money you get to keep, and grow.

- On Making Money Work for You: Invest in learning about the process on how you can turn your hard earned income into passive income through real estate investing. Learn about taxes, reading financial statements, the difference of assets and liabilities, etc.

The end result of these steps is freedom—and when I say freedom, it is freedom in every way possible. Are you now ready to make your money work for you through investing in real estate?

Conclusion | Robert Kiyosaki Quotes

One of my favorite quotations from Rich Dad Poor Dad by Robert Kiyosaki is ‘Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.’ Let me leave it at that.

I know that the philosophies of Rich Dad series served me well. Rich Dad Poor Dad Summary is financial education at its best. Please also take a quick peek at the cashflow quadrant concept from Rich Dad Poor Dad series.

Have you read this book already? I’d love to know what you think about it!

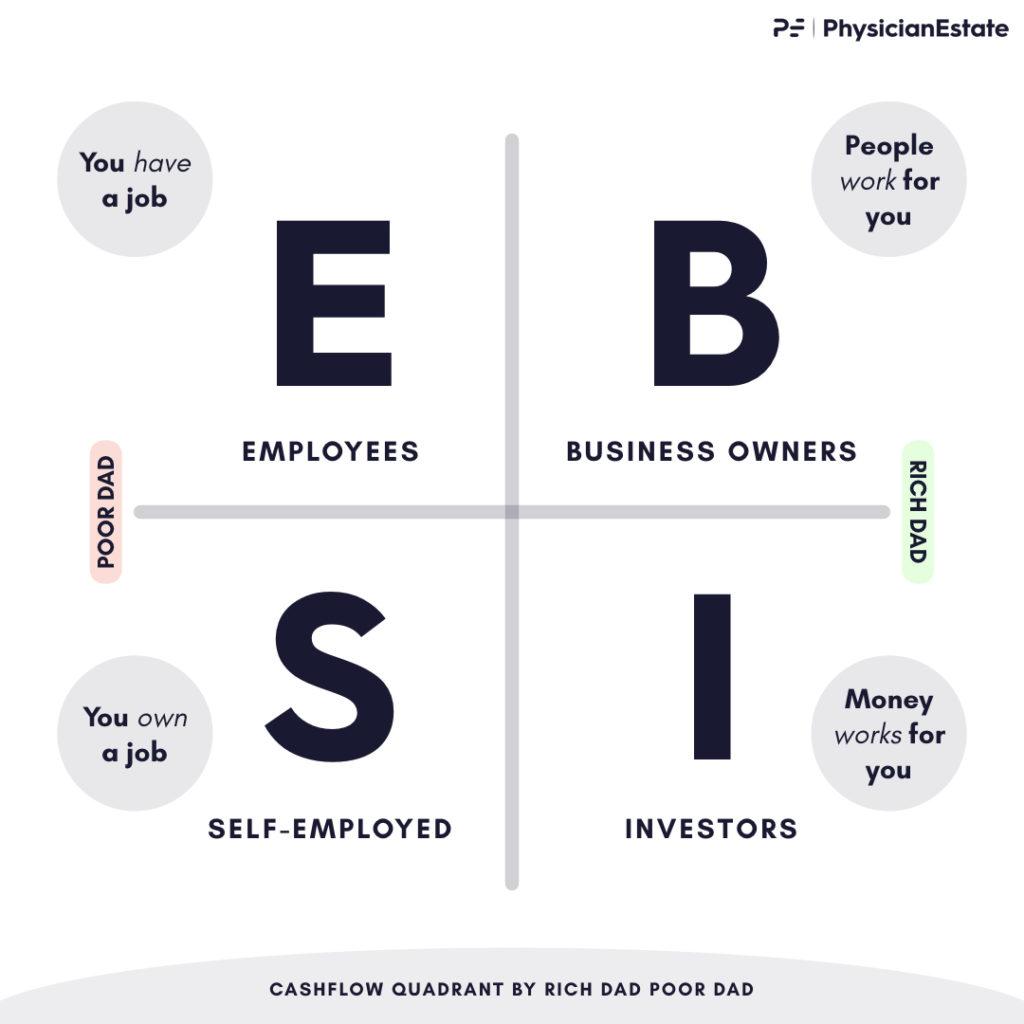

Cashflow Quadrant by Robert Kiyosaki (Rich Dad Poor Dad)

Cashflow Quadrant by Robert Kiyosaki (Rich Dad Poor Dad). “The only reason I built businesses was so I could invest in the investments of the rich. The only reason you build a business is so that your business can buy your assets. Without my businesses, I could not afford to invest in the investments of the rich.” –Rich Dad

The cashflow quadrant by Robert Kiyosaki is such an eye-opener. I have applied the lessons that I learned from this concept in my life. While this blog post focuses on the cashflow quadrant topic from Rich Dad Poor Dad, the complete overview of the general concepts from Rich Dad Poor Dad summary are included in another blog post!

The Components of the Cashflow Quadrant by Robert Kiyosaki

- E Quadrant (Employees): These are the people who work from 9-5 for businesses or corporations and follow a certain workflow or system. People in this quadrant come from all walks of life—from janitors to presidents of companies.

- S Quadrant (Self-Employed): These are professionals with formal education and specialization such as doctors, attorneys, engineers, accountants, etc.

- B Quadrant (Business Owners): Being a business owner means you own a system and people work for you. Having a business will give you the best chance for great wealth and financial success.

- I Quadrant (Investors): These are people who invest their money in stocks, real estate, small businesses, corporations, etc. Being an investor means money works for you.

Different Quadrants, Different Paths

Poor Dad’s Advice: “Go to school, get good grades, and then find a safe secure job with benefits.” Poor dad values job security and he holds on to the retirement plan offered by the government.

Rich Dad’s Advice: “Learn to build businesses and invest through your businesses.” Rich dad believes in the power of businesses for it will buy your assets with tax benefits.

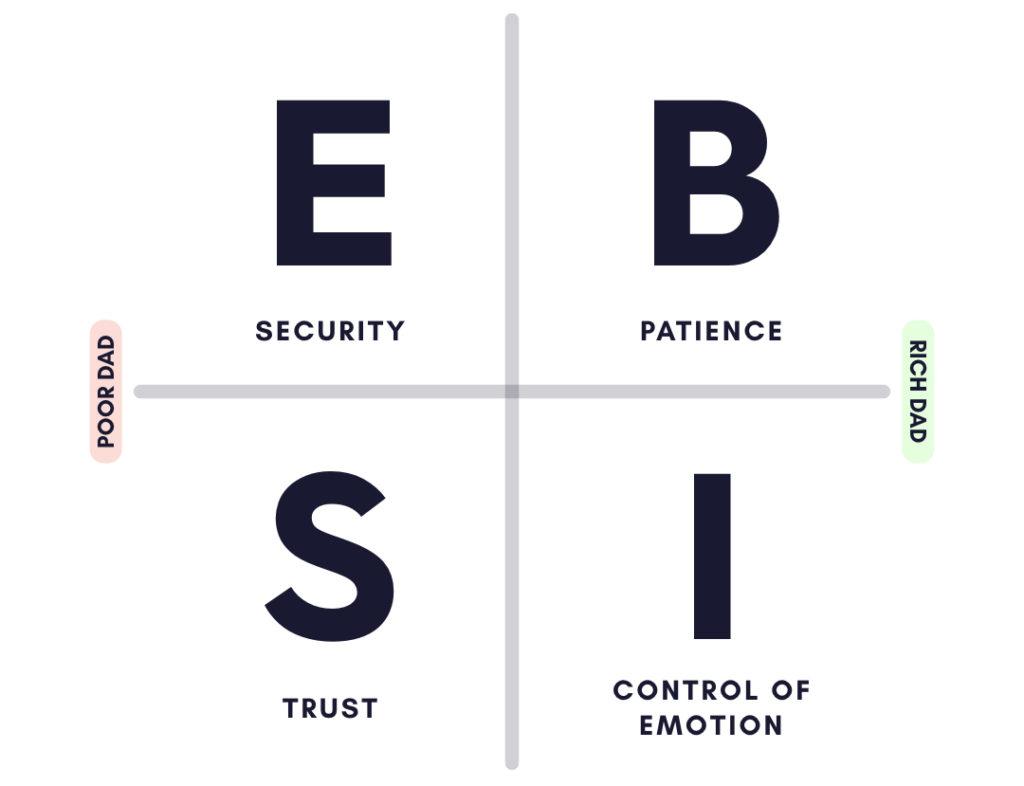

Emotional Differences of the Quadrants

People in different quadrants have different emotions. These differences are crucial for they are triggers/reasons as to why these people fall under their respective quadrants. For example, someone who values job security belongs in the E quadrant, and so on.

Difference in Investment Capabilities

There is a big difference between an employee buying an investment and an affluent business owner buying an investment. Not all investments are available for employees. Meanwhile, there are investments that are available only for affluent business owners—investments that have the least risk with the highest returns. That’s why rich dad says that there’s such thing as ‘investments for the rich’—these people are also known as accredited investors.

Hence, the ultimate goal is to move from the left side of the quadrant to the right.

Take a few minutes and ask yourself these questions:

- Which quadrant do you currently belong to?

- Which quadrant do you want to belong to in the long-term?

- What goals will you set to get to that quadrant?

Did you like this concept from Rich Dad Poor Dad series? Please also take a quick peek at the summary of lessons from Rich Dad Poor Dad!

Here at PhysicianEstate, we provide free entrepreneurial resources (to physicians in the US) and scientific COVID-19 related content.

Stay in touch with us by signing up for our newsletter. The newsletter will keep you up to speed on the current syndication deals we are looking at, provide physicians with investment opportunities, and much more.

Legal Disclaimer: This is not investment advice. I am not a legal and/or investment advisor. This is my personal blog, and all information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. These are my views, it is not a production of my employer, nor is it affiliated with any broker/dealer or registered investment advisor. While the information provided is believed to be accurate, it may include errors or inaccuracies. To the maximum extent permitted by law, PhysicianEstate disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. You should consult with an attorney or other professional to determine what may be best for your individual needs. Your use of the information on the website or materials linked from the Web is at your own risk.